How much money you need to buy a home in Portland

As you may have heard by now, Portland has quite a busy housing market. At just 45 days, homes in Portland are selling much faster than the national average. In order to stand out as a buyer, people have been known to write “love letters” to people selling their homes in Portland. There have also been times in Portland where people have paid way over asking price just to make sure that they have the winning bid.

So, what does it take to find your dream home in Portland AND present an offer the seller can’t refuse? And, how much does all that cost?

Things to know about buying a house in Portland

Every state has their special circumstances and nuances, and Portland is no exception. The large variety of housing styles available in the Portland metro can play a part in creating some interesting scenarios that, if you’re looking to buy a house in Portland, you should probably know about beforehand.

Here are a few potential surprises you could encounter when buying a house in Portland:

Radon

The majority of the soil across the USA emits a gas called “radon.” Moderate to high levels of radon are present in more than two-thirds of the United States. It is a radioactive, colorless, odorless, tasteless, and highly-toxic noble gas. Portland is a moderate-risk zone, but there are areas where the risk is on the higher end.

The risk for radon tends to be higher on the eastside of Portland than on the west.

Your home inspector should test for radon or offer radon testing as part of their service. They place a testing machine in the basement of the house and will leave it there for 1-2 days. If you do have radon in your potential home, you can install or ask the current owner to install mitigation device for around $1,400. This is also something that could also potentially be provided as a closing credit for the cost of the mitigation device (installed) if the owner doesn’t want to purchase and install it themselves.

It is worth noting that you don’t have to have a basement to have high levels of radon gas, and newer homes tend to be better sealed, so they are less likely to have high levels of radon. There are also new homes that have been explicitly designed to mitigate radon.

Flood plains

If a house you like is on a floodplain, your lender may require you to carry additional specialized flood insurance.

At $1,000k + per year, this insurance can cost 2-3 times the amount that your regular home insurance does and it’ll be in addition to it. Check with the City of Portland to see if the home you have chosen is in a flood plain. If so, check with your lender to see if they require flood insurance on the home.

The Quick Offer and The Dead Offer

With homes in Portland selling way faster than most states, at an average of 45 days, you need to be quick on your toes.

To get your dream house in a hot market like Portland, you’ll need to get pre-approved. In order to get to that stage, you should start by getting pre-qualified. Getting pre-qualified will give you a good idea about how much house you can afford. Getting pre-approved shows the sellers that you can afford their house and that you’re serious about buying it.

When buying a house, it’s critical that the loan paperwork goes through quickly. This is particularly true in a fast-turn market such as Portland and when the buyer is also selling their house at the same time.

Our preferred lender, Willamette Valley Bank, is local to Portland. Local banks are much more nimble and better connected to community decision-makers than national chain banks.

Our go-to guy at New American Funding is Addison Nett.

He can get loans approved by the bank and accepted by the seller’s agent faster than lenders at most large banks. No matter if you’re buying for the first time, buying after renting, or selling your house elsewhere, the process is almost always much faster when you go local.

Many out-of-state loans handled by New American Funding, are what are called “same-day close” loans. This means that the proceeds from the house that you’re selling go towards buying the new house and it all happens on the very same day. Having a same-day close means that you won’t need to pony-up the cash for the new house while waiting for the transaction to go through on your sold house.

Down Payments for Portland Homes

If you have some decent savings but don’t think you have enough for a down payment, you probably actually do.

One of the most common concerns that we hear from people relocating from markets outside of Portland is the myth that they need a large down payment of 20%, 50%, or even 70%. In fact, the average down payment for a relocation client we typically see is anywhere from 3% to 10%, most commonly falling right in the middle around 5%.

So there are a lot of different ways to purchase a home here in the Portland market without needing a massive down payment.

Anything less than 20% will usually come with a requirement to pay private mortgage insurance (PMI). PMI gives the lender extra assurance that you’re good for the money. It’s separate from home insurance or other specialized insurances.

After a home is paid down to an 80% loan-to-value ratio (LTV), it’s eligible to have the PMI removed. Unlike MIP that you get with an FHA loan (more on that below), private mortgage insurance must be automatically removed by the lender once your house is below 78% of its initial LTV.

In some circumstances, you can apply to have your PMI removed if you home has appreciated enough to bring the LTV up to 80%. This usually requires either a new appraisal by the lender or a refinance. Even though they typically carry their own fees, and depending on your particular circumstance, both are usually very viable options.

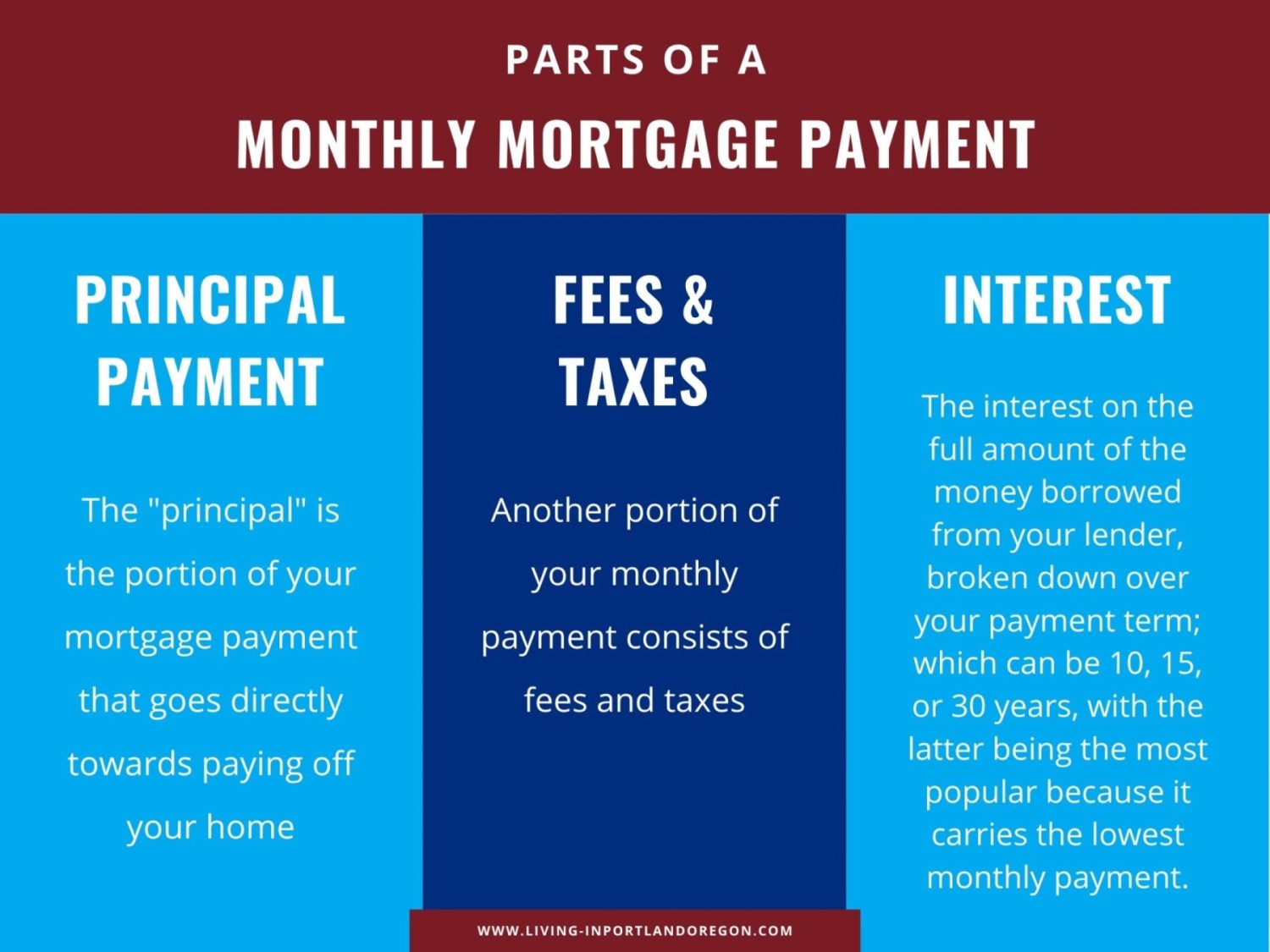

Monthly Mortgage Payments

How much you can afford to pay for a house is determined by a long list of factors.

A few of the key components will be income, debt, and credit score. You and your lender will also want to be sure that you can comfortably afford the monthly mortgage payments after the initial purchase.

Monthly mortgage payments are made up of different parts.

Typically, the longer the payment term, the more you will pay in interest over the life of the loan because shorter-term loans tend to have the benefit of lower interest rates. Shorter-term loans, however, will increase your monthly payment because you’re paying off the full amount in less time.

Read More: Cost of Living in Portland, Oregon

Types of loans

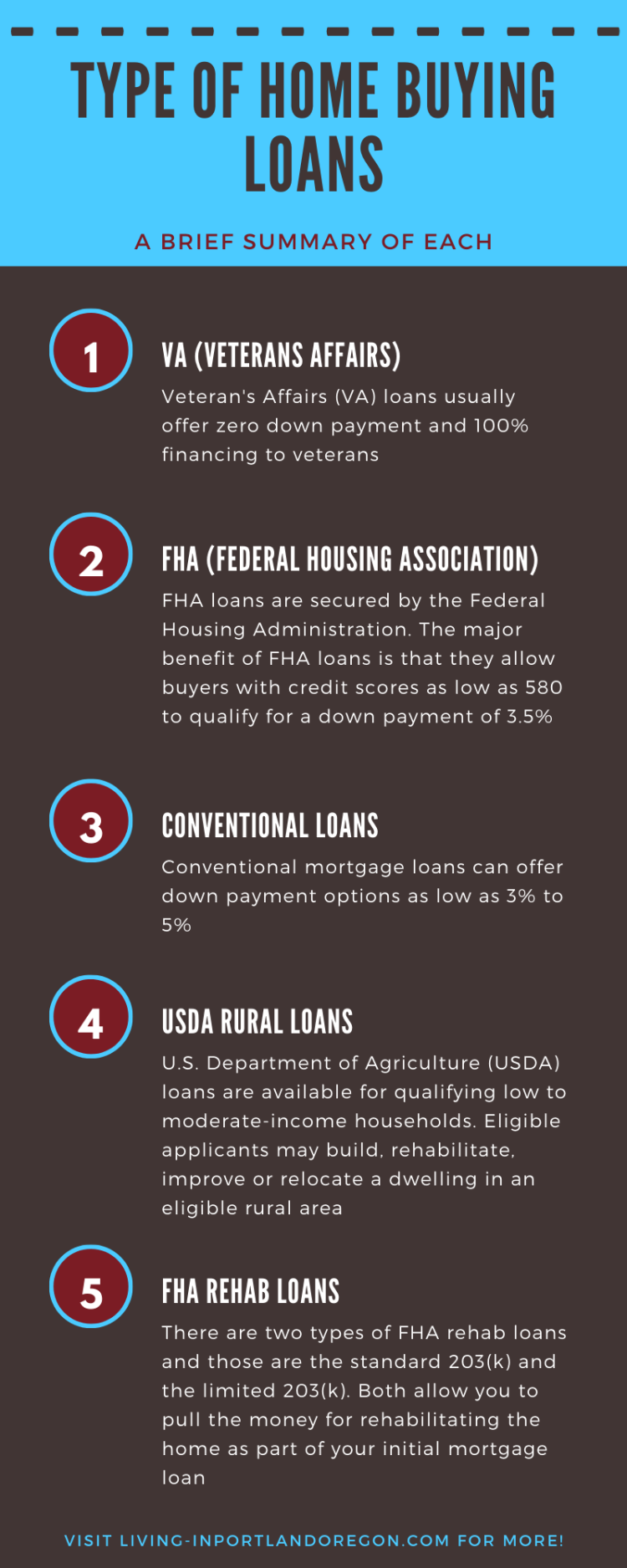

Types of Home Loans

VA Loans

Veteran’s Affairs (VA) loans usually offer zero down payment and 100% financing to veterans. The requirements for VA loans, in most cases, will be one of the following:

- The applicant has spent 90 consecutive days in active service during wartime

- Has served 181 days of active service during peacetime

- Served 6 years in the National Guard or Reserves

- Or is the spouse of a service member who died in the line of duty or due to a service-related disability.

According to our preferred lender, Addison Nett of New American Funding, one of the biggest misconceptions about VA loans is that they’re time-consuming and difficult to obtain. How does this myth affect a veteran trying to buy a house?

Well, it’s actually quite common for the sellers and the selling agent to not even select VA financing as an option. This is because many sellers and their agents believe that VA loans are headache-inducing and will slow the sale of the home.

With the right lender, VA loans are just as easy as any other loan. Knowing that this can often be a problem for veterans, a good lender will proactively introduce themselves to the seller’s agent and take time to explain the actual truths about VA financing. Addison says that this extra care is much more common with a local lender than it is with a national lender, “we simply take some time to explain what the truths are” he notes, “that’s where having boots on the ground really serves you.”

FHA Loans

Federal Housing Administration (FHA) loans let borrowers put down 3.5% of the purchase price of a house.

FHA loans are secured by the Federal Housing Administration. The major benefit of FHA loans is that they allow buyers with credit scores as low as 580 to qualify for a down payment of 3.5%. Down payments under 20% of the cost of the house are subject to an upfront mortgage insurance premium (MIP). Different from the PMI required on some conventional loans, MIP is put in place to protect the lender if a borrower defaults on their loan but it comes with an initial fee as well as a monthly fee.

Similar to PMI, the MIP is in addition to regular house insurance and any other special insurances.

The MIP has two costs.

1. Firstly, the MIP has an upfront premium (UFMIP) of 1.75%. The upfront payment can be rolled into the FHA loan to be paid off on a monthly basis until the balance of the upfront payment is satisfied.

2. The second fee associated with this type of lender insurance is a monthly fee that’s typically 0.85% of the loan amount.

In the long run, an MIP is not necessarily more expensive than the PMI on a conventional loan (which can range from 0.5% to 2%). Each type is calculated on a case by case basis.

If you received your FHA loan before June 2013, you are eligible for MIP cancelation after five years as long as you have 78% LTV/equity of 22% in the property, and as long as you made all payments on time. For homeowners with FHA loans issued after June 2013, the requirement for removing MIP is that you refinance into a conventional loan and also have a current loan-to-value ratio of 80% or more.

Read More: Top 5 Neighborhoods to live in Portland

Conventional Loans

Contrary to popular belief, conventional mortgage loans can offer down payment options as low as 3% to 5%. The way these differ from FHA loans is that they require a credit score of 620 or above, whereas credit scores can be as low as 580 for FHA. In many cases, if you do qualify for an FHA loan, but your credit is above 620, you might get a better rate with a conventional loan (and be able to go as low as 3% down instead of 3.5% down).

If you’re planning on putting down less than 20% of the value of your new home, your lender will require private mortgage insurance. To remove PMI, your loan to value ratio (LTV) must be 80% or greater. This means that you’re subject to PMI until you’ve paid 20% of the value of your home. Once you hit that magic ratio, the lender is required to remove your PMI.

There is, however, a little-known way to speed up the PMI removal process. If your home has appreciated in value enough to bring your loan-to-value ratio up to 80%, you can request to have PMI removed. This request must be in writing. Another main requirement is that you must have a good payment history. Your lender may ask you to certify that there is no second mortgage on your home. Your lender might also request an appraisal, and require that you use their appraiser (for a fee).

USDA Rural Loans

U.S. Department of Agriculture (USDA) loans are available for qualifying low to moderate-income households. Eligible applicants may build, rehabilitate, improve or relocate a dwelling in an eligible rural area. The program provides a 90% loan note guarantee to approved lenders in order to reduce the risk of extending 100% loans to eligible rural homebuyers.

So, at the end of the day, you can still get 100% financing because the lender provides the remaining 10%. More information on eligibility requirements for USDA rural housing loans can be found here.

FHA Rehab Loans

If you’ve found a property with great bones but it needs a little TLC, rehab loans could help you out. There are two types of FHA rehab loans and those are the standard 203(k) and the limited 203(k). Both allow you to pull the money for rehabilitating the home as part of your initial mortgage loan. The standard 203(k) will allow almost any type of repair or improvement. In many circumstances, it will even cover the reconstruction of a demolished home, as long as the original foundation is still in place. Repairs must cost at least $5,000, and you will need to hire a 203(k) consultant who will assess whether the project is financially viable, they will also oversee the work being done.

The limited 203(k) can be used for smaller projects that won’t require structural changes.

These loans do not carry the consultant requirement or the minimum repair cost requirement, but the amount you can borrow is more restricted. The limited 203(k) can be used to repair flooring, windows, doors, siding, heating and cooling systems, plumbing, electrical systems, decks or outdoor patios, roofs, and gutters. It can also be used for some upgrades that will increase the value of the home.

Documents Needed to Buy a House in Portland, OR

Paperwork will usually be requested in bite-sized chunks when you buy a home. You will submit initial paperwork, and the lender will then usually ask for any additional backup information to support your original documents.

It’s important here that you’re as thorough as possible when providing documents so that the process isn’t slowed by the lender having to make more requests for detailed information. Much as most people would when lending out money, the lender wants to get a holistic view of your regular income, financial situation, and the way that you handle your finances. They want to be able to evaluate the amount of risk they’re taking in providing a loan.

To be able to paint your financial picture, lenders will usually ask for tax returns, bank statements, pay stubs, other income, letters to explain any irregular income such as a monetary gift, credit score information, rental history, a copy of your ID, and potentially some other documents.

But you’re moving… so how will you provide pay stubs for a job you haven’t even started yet? All that most lenders need to see is an offer letter from your new job showing your compensation structure.

Read More: Pro’s & Con’s of Living in Portland, Oregon

What if you have fairly extreme debt?

Another common discussion is debt.

We work with Addison Nett of New American Funding because he knows the market and the right people.

Regarding people who are wanting to move to Portland and purchase a house but are concerned about their debt, Addison says, “I really help people wash out their debt. If they’re selling a home and they’re coming here to Portland, we’re going to reduce their monthly payment by getting them into a more affordable house and reduce that credit card debt or personal loans that they might have acquired over the years of living somewhere else. So they’re just starting fresh with a low overhead.”

Need Help moving to Portland?

Addison Nett of FOA Mortgage is our trusted local lender for a reason. Not only is he great at what he does, but he specializes in out-of-state relocations and is licensed in basically every state. So if you’re thinking about moving to Washington or Oregon, he comes highly recommended by us.

We’re local real estate agents who are licensed in both Oregon and Washington and can leverage our robust expertise, knowledge, and experience of the local market to help you find your dream home.

We have homes available in every style and for every budget. Whatever your ideal home is, we’d be more than happy to help you settle into one of America’s fastest-growing cities.

Contact Jesse Dau or Jackson Wilkey today to see available homes in the Portland metro.

P.S. Join your local peers!

Join our active Facebook group to get to know the city & the real estate market better

Or message us to day with your questions

Pin for later

About Real Agent Now Group

Jesse & Jackson are high-touch broker’s known for their extensive market knowledge and unmatched devotion to clients.

Their success is based almost exclusively on positive referrals. They earn the respect of their clients by working tirelessly on their behalf and by always offering them candid advice.

Get to know them better by checking out their Portland and real estate YOUTUBE CHANNEL.